China’s central bank is working to increase adoption of its digital yuan, or e-CNY. The bank is enlisting help from the private sector to take its official digital money to a broader user base and has a designated app for e-CNY that crossed 261 million individual users in early 2022. However, there are concerns that the heavy reliance on the private sector could lead to vulnerabilities in the system.

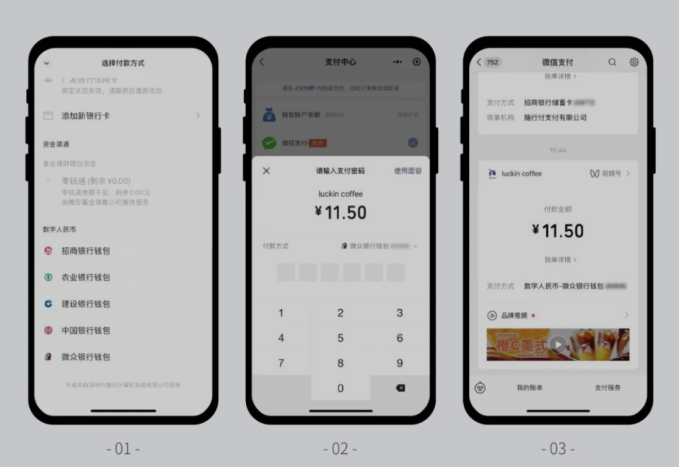

WeChat is hoping to tap into the growing e-commerce market in China by extensiong the use of its e-CNY payment system to transactions happening through its short video and mini-app platforms. This move will allow small influencers, brands touting products on WeChat, and even individual merchants to take advantage of WeChat’s massive user base.

WeChat is a messaging app with many features that can easily be standalone apps. It has its own payments system, WeChat Pay, which competes with other popular payment systems like PayPal and Square Cash. It also has a short video network that competes with Douyin, TikTok’s Chinese version, for eyeball time. Other features include support for Millions of third-party lite apps and its own super app store called Wēixīng Jìzhù (微信支付), which gives users more options to find and download Apps from the App Store-style catalogue. WeChat is one of Asia’s most popular messaging apps, used by millions of people around the world

Clearly, Tencent is bullish on the potential of WeChat mini apps – and they’re not the only ones. The company generated $1 trillion in transaction value on its platforms last year alone, which gives them an enormous potential market. Microtransactions are clearly a target for these apps, and as such we can expect to see even more innovation in this area over the next few years.

This development means that WeChat users will have a wider range of payment options when shopping in China, as well as abroad. Merchants who accept e-CNY can now take payments directly through the app, eliminating the need for customers to exchange traditional currency into digital yuan.

“Our chat app WeChat is now available in more than 800 million active users’ hands, and we’re

WeChat Pay and Alipay are by far the most popular digital payment methods in China, accounting for approximately two-thirds of all digital payments made in the country. This dominance is likely due to the convenience and ubiquity of these platforms, as well as their strong partnerships with various retailers across the country. While the central bank has set up a network of e-CNY payment gateways at online and offline retailers across China, WeChat Pay and its rival Alipay, Alibaba’s affiliated payments method, are still by far the most ubiquitous digital payment methods.

The central bank regulator made it clear that digital yuan isn’t meant to compete with the two payments giants. Rather, it’s supposed to play a complementary role. As digital yuan becomes more prevalent, it could help spur growth in the sector and improve financial inclusion for consumers.

For instance, it could support anonymity for small-value transactions just like physical cash. In other cases, large amounts of funds sent from a provincial government to a town could be paid in e-CNY to prevent corruption using the digital currency’s traceable capabilities.

While Bitcoin and other digital currencies are hovering around $10,000 per coin, the use of virtual currencies has the potential to revolutionize smaller transactions. E-CNY could be used for small-value transactions just like physical cash, or large payments between provincial governments could be paid in e-CNY to prevent corruption.

Digital yuan users have to verify their real identities before using the wallet, but this is only required for transacting parties involved. Any user can use digital yuan, regardless of their verified identity. As with all other forms of internet services in China, digital yuan users have to comply with the strict regulations and limitations imposed by the Chinese government.

The frying pan video that the user sees is advertising the frying pan and also selling it on WeChat Pay. The user’s bank account has been linked to WeChat Pay, so they are directed to buy the frying pan using their digital yuan wallet. This intersection of commerce and technology is an emerging trend that TikTok is trying to capitalize on by integraging commerce into its short videos.