CRED, a fintech startup based in Bengaluru and valued at $6.4 billion, has recently received in-principle approval from the Reserve Bank of India for a payment aggregator license. This is a significant boost for the company, as it will allow them to better serve their customers, launch new products, and experiment with ideas at a faster pace.

According to two sources familiar with the matter, the central bank typically takes nine months to a year to issue full approval following in-principle approval. This has been the case with other companies, such as Reliance Payment and Pine Labs, who have also received similar approvals over the past year.

When asked for comment, CRED did not immediately respond.

“Payment aggregators are essential in facilitating online transactions by acting as intermediaries between merchants and customers,” an industry executive said.

This RBI approval enables fintech firms to expand their offerings and compete more effectively in the market. Without a license, they would have to rely on third-party payment processors, who may not prioritize such mandates. However, with a license, fintech companies can process payments directly, reduce costs, gain greater control over payment flow, and onboard merchants directly. Additionally, payment aggregators with licenses can settle funds directly with merchants, providing more efficiency and control.

The industry executive also noted that this license would allow CRED to be available to more merchants and “generally be everywhere their customers shop.” This will undoubtedly prove beneficial for the company and its growth.

This approval comes at a time when the Indian central bank has been cracking down on many fintech business practices and has generally been cautious in granting licenses of any kind. In fact, earlier this year, the Reserve Bank of India ordered Paytm Payments Bank to halt most of its businesses, causing significant disruption.

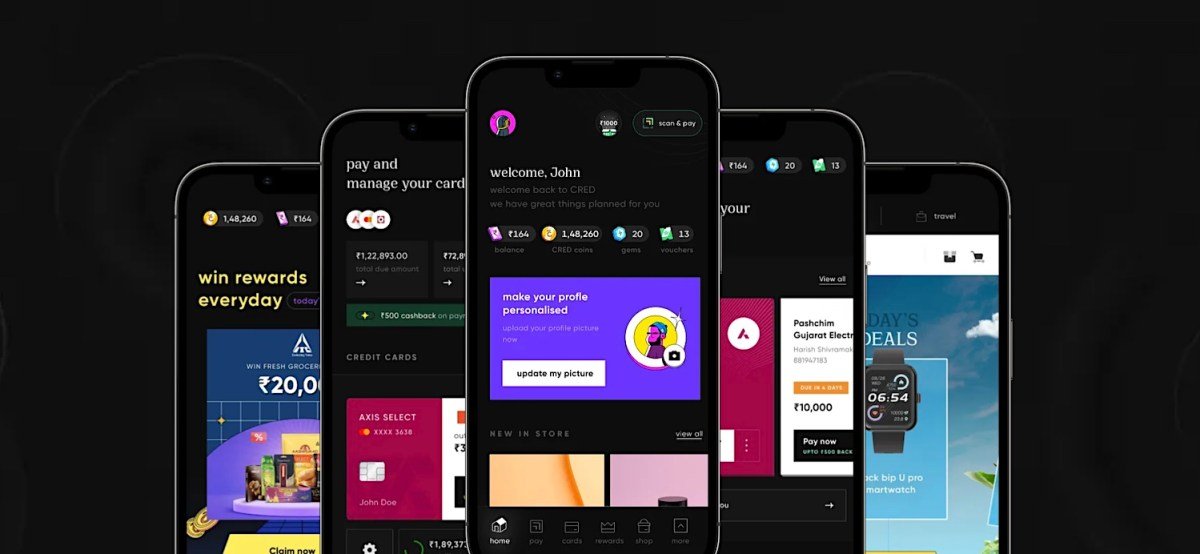

CRED, backed by prominent investors such as Tiger Global, Coatue, Peak XV, Sofina, Ribbit Capital, and Dragoneer, caters to a large segment of India’s affluent customers. It originally launched six years ago with the feature of helping members pay their credit card bills on time, but it has since expanded its offerings with loans and several other products. Most recently, in February, the company announced its agreement to acquire the mutual fund and stock investment platform, Kuvera.