Ethiopian startup eQub emerged victorious in the fintech pitch-off at 4YFN 2024, the startup event of Mobile World Congress. TechCrunch had the opportunity to meet with their business development lead, Nahom Michael, on the ground in Barcelona this week.

The startup’s name, “eQub,” is an Amharic word that refers to a local form of peer-to-peer credit

Michael explained that an Equb is a group of individuals who come together to save money, redistributing it on a rotating basis.

This traditional financing approach, known as a rotating savings and credit association, or ROSCAS, is common in countries around the world, with a particularly strong presence in Africa. Currently, it remains largely untouched by the digital age.

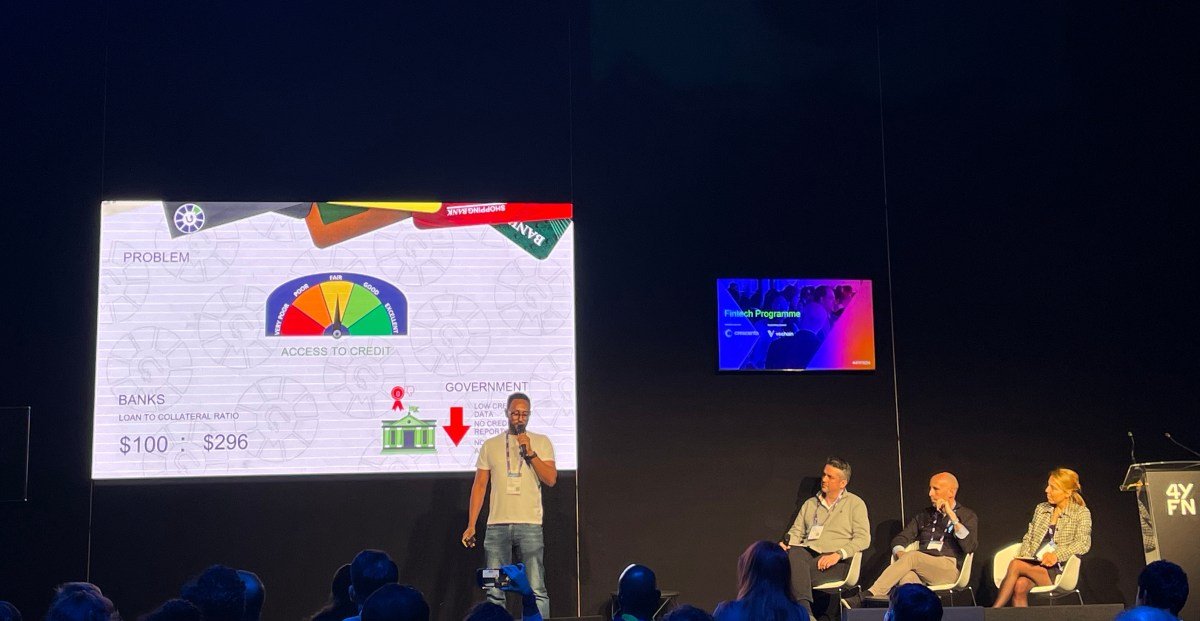

That’s where eQub steps in. Starting with an app, the startup is targeting individuals in Ethiopia who possess bank accounts and mobile phones, yet have limited access to credit.

By digitizing the Equb, eQub brings convenience to its members. Those with bank accounts can add money to their Equb without having to visit an ATM, and administrators no longer have to deal with piles of cash.

In addition to convenience, eQub’s point system allows users to establish a credit history by demonstrating consistent saving habits. In the future, the company plans to expand to include buy-now-pay-later options, loans, and more. For now, however, eQub is sticking to the original ROSCAS model: no collateral or interest. Instead, they charge a fee for each transaction.

In his presentation, Michael shared that since its launch, the app has gained approximately 25,000 users and has formed 200 saving groups. He also revealed that the app offers two options for users: join an existing group or join a group curated by the startup itself.

eQub has taken measures to ensure the safety of its users’ savings, whether they join a self-managed group or a curated one. Self-managed groups undergo detailed know-your-customer (KYC) procedures, which is already more thorough than traditional, offline Equbs. This is due to the fact that self-managed groups often consist of individuals with personal ties, unlike curated Equbs.

In the case of curated groups, Michael explained to TechCrunch via text, the requirements are even more rigorous, including a digital national ID, employment letter, or business license to prove consistent income. In addition, users must provide 3-6 months of bank statements, and a digital agreement must be signed allowing eQub to take legal action in the event of any issues.

Currently, eQub has partnerships with over 10 banks, which also helps to minimize risks through data sharing. They have seen interest from insurance companies who are willing to offer limited policies for saving groups in the event of a member’s passing.

In addition, the startup has formed partnerships with 20 companies for its B2B2C strategy. This allows companies whose employees already participate in Equbs to make the process digital.

eQub’s next target is gig workers, a significant portion of the workforce in sub-Saharan cities. They hope to reach 1 million of these users by 2025. However, to achieve faster growth, eQub will need to invest in marketing. That’s why the company is currently seeking a $500,000 pre-seed round. With the exposure they received at MWC, they are optimistic about reaching this goal and expanding into other countries in the near future.