TikTok Shop is causing a stir in the e-commerce world, with merchants from all over flocking to the platform as an alternative to Amazon.

In March, the U.S. House of Representatives passed a bill that could potentially force ByteDance, the parent company of TikTok, to sell the app or face a ban in U.S. app stores. While much of the discussion surrounding this decision has focused on data security and speech rights, one thing that may be overlooked is the impact on e-commerce. TikTok has been steadily growing its e-commerce focus, but the influence of tech giants and political tensions is putting pressure on smaller merchants.

Merchants, predominantly from China, have been turning to TikTok as a way to sell their products to U.S. buyers, using the platform’s recently launched feature, TikTok Shop. In interviews with TechCrunch, several sellers expressed frustration and a sense of “helplessness” over the uncertainty of a potential ban and its effect on their businesses. “The situation is not within our control,” said one retailer who specializes in maternity and baby products. “We just have to play it by ear.” (Names have been withheld due to political concerns.)

TikTok Shop’s Impact

TikTok Shop officially launched in September 2023 with 200,000 merchants already on board. However, there has been no updated information on the current number of sellers, their sales on the platform, or how many sell on other platforms. Research from Jungle Scout, an Amazon data intelligence provider, shows that 20% of Amazon sellers, brands, and businesses plan to expand to TikTok Shop this year. Before the political backlash, ByteDance projected a potential tenfold growth in their U.S. e-commerce business, reaching $17.5 billion in 2023.

TikTok is not the only marketplace that merchants are turning to in search of new channels outside of Amazon. The rise of alternative marketplaces, such as Temu, is gaining attention from Chinese e-commerce exporters and merchants, with even Amazon taking notice. This indicates a growing trend towards diversifying channels for merchants.

A New Way to Sell and Buy

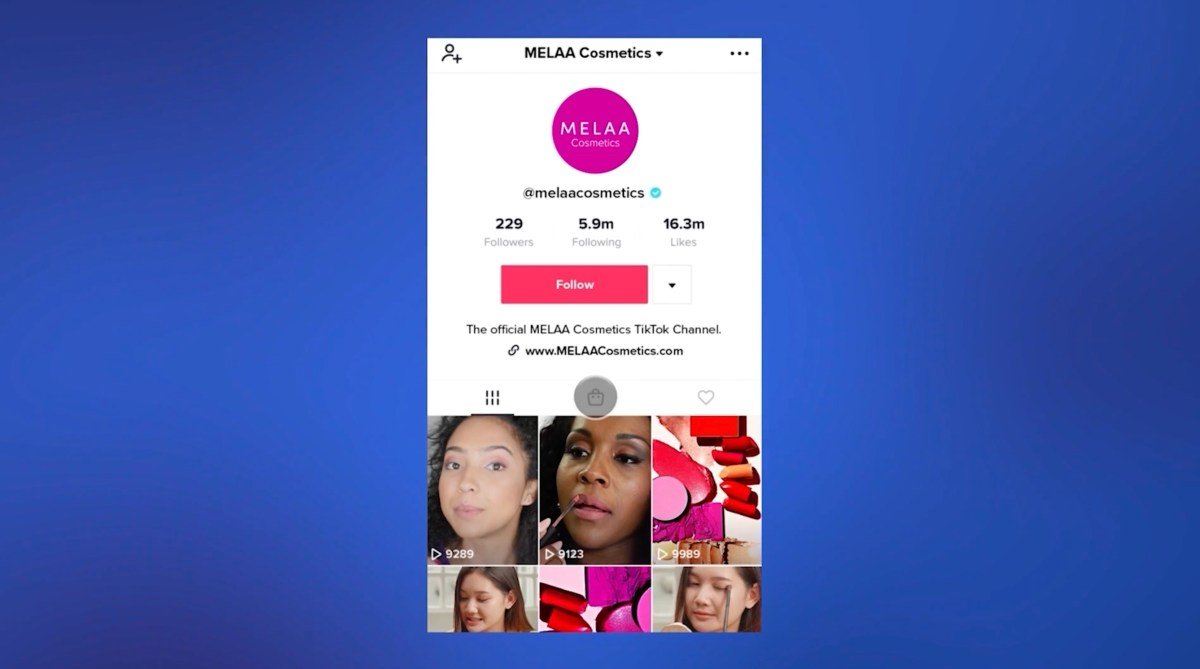

TikTok has been actively trying to expand their e-commerce presence since their launch in the U.S. last September. With the app’s reputation for tightly controlling content, TikTok Shop also heavily curates its featured products.

Unlike Temu, which is known for selling cheap, white-labeled products from Chinese factories directly to U.S. consumers, TikTok’s approach is to onboard and highlight branded goods, making it a direct competitor to Amazon. TikTok is also offering incentives, such as subsidies, to encourage merchants to offer steep discounts to consumers. According to reports, during the most recent Black Friday sales period, TikTok provided subsidies to merchants to mark down their prices by up to 50%.

Aside from financial incentives and specialized algorithms, merchants are also drawn to TikTok for its massive engagement. A survey by Tabcut, a Chinese firm that tracks TikTok Shop performance, showed that nearly 70% of sellers reported increased sales year-over-year for the first 11 months of 2023. This is in line with consumer behavior, as younger consumers continue to be influenced by products endorsed by influencers.

With 52% of TikTok’s U.S. users being aged 18-34, the app has the potential to shape how the younger generations shop online. In fact, a report funded by TikTok and conducted by commercial research firm Oxford Economics estimated that a presence on the platform resulted in a staggering $14.7 billion in revenues for the 7 million small and medium-sized businesses in the U.S. using TikTok through advertising or marketing on their own accounts.

TikTok’s Challenger?

TikTok’s recent efforts to expand its e-commerce presence may be in jeopardy due to the political turmoil surrounding the app. While the company continues to roll out new e-commerce features, such as a video shopping format, it is also dealing with rapidly changing seller policies and restrictions as it navigates how to grow under intense scrutiny.

“TikTok’s [Shop] internal management is a bit chaotic right now. It’s a new platform, so it hasn’t started squeezing sellers, but its policies are still changing,” said a merchant who sells lamps and has been selling on Amazon since 2010. One of the policies that has come under scrutiny is how the app’s algorithms surface products to consumers. According to Chinese merchants, TikTok Shop has been favoring U.S.-based shops over foreign ones, leading to the rise of “agents” who broker deals between foreign sellers and American residents who set up TikTok Shops that appear to be U.S.-owned but are actually run by the foreign merchants.

Despite these challenges, merchants are drawn to TikTok as a way to expand their reach and channels. Juozas Kaziukenas, founder of Marketplace Pulse, an e-commerce intelligence firm, believes that while TikTok may never replace Amazon, it has the potential to gain a significant share of the e-commerce market. “Many people spend hours on TikTok every day, and sometimes they will buy things on it,” he said. In the U.S., shopping apps have traditionally been used for entertainment and connection, while retailers like Amazon are now trying to incorporate social elements, such as through Amazon Inspire. However, the current trend is still towards using different apps for different needs, rather than relying on one platform for all.

“While 15% may seem small, it still equates to $285.2 billion in the U.S. retail market,” explained Richard Xu, partner at Starting Gate Fund, who invests in cross-border retail solutions between China and the U.S. TikTok’s strategy of bringing offline businesses online through live streaming e-commerce could have a significant impact on this market. Seizing this opportunity, however, depends on navigating the current political climate and continuing to evolve as a platform. As Xu noted, “We need to understand the overall retail market in the U.S. to truly gauge TikTok’s potential impact.”